Ben Molin & Lauren Schoneker • May 2025

SNAP benefit amounts are based on a household's net income, which takes certain household expenses into consideration as deductions. The more deductions that can be claimed by a household, the higher the benefit amount that household can receive.

Currently, the standard heating and cooling allowance is the highest utility deduction, and it can be received by people who either 1) pay for their heating/cooling separately from their rent or 2) people who receive over $20 in energy assistance payments from the Low-Income Home Energy Assistance Program, (LIHEAP).

SNAP households whose heating and cooling utility bills are included in their rent payments are not eligible to receive the standard heating and cooling allowance. The result is that many low-income households miss out on SNAP benefits even though they still pay for those utilities in their rent payments.

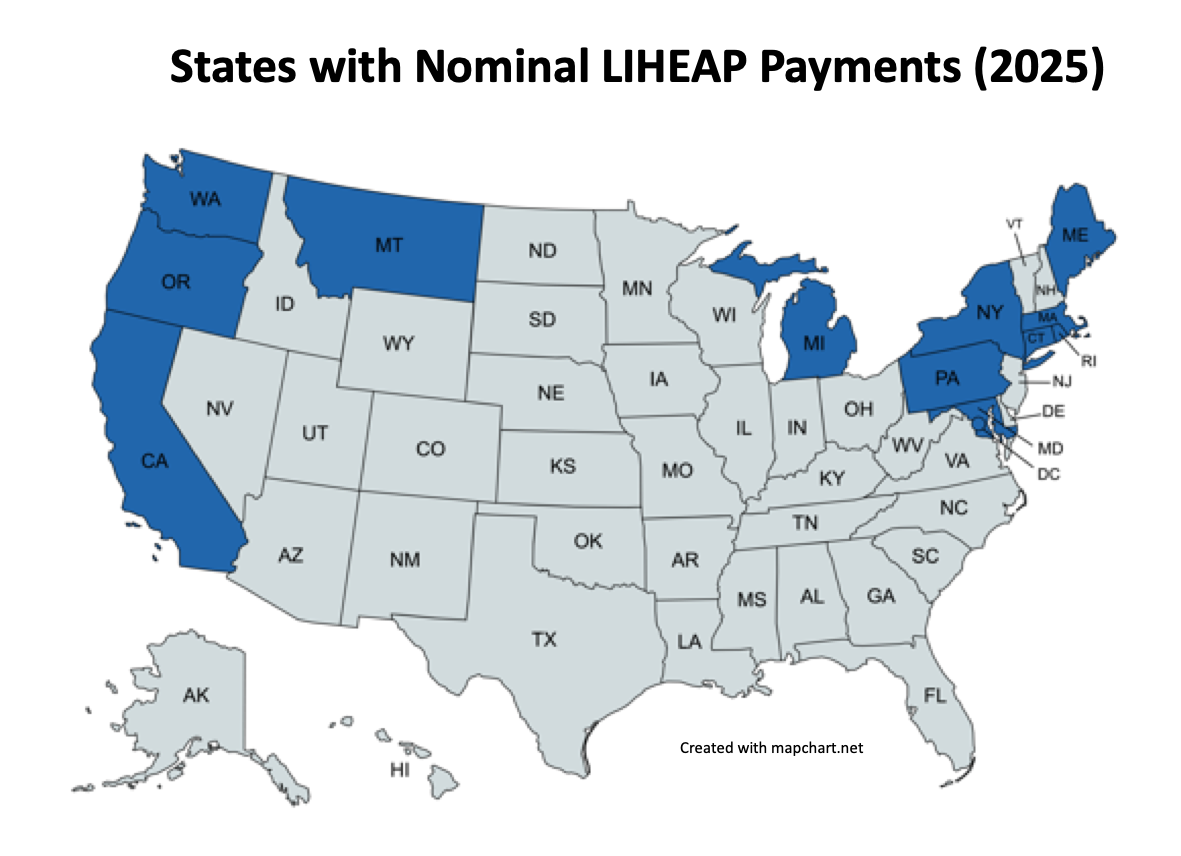

To address this, some states have chosen to implement "Heat & Eat" programs, which provide SNAP households whose heating/cooling costs are included in their rent† with a small ("nominal") annual LIHEAP payment, typically $20.01, so that they can qualify for the standard heating and cooling allowance. Heat & Eat programs level the playing field by ensuring that SNAP recipients who pay for their utility bills as part of their rent can receive the same benefit amounts as those who pay for their utility bill separately.

States with 100,000+ SNAP households benefiting: NY, MD, WA, PA, MA, *CA

States with 0–100,000 SNAP households benefiting: CT, MI, RI, OR, ME, MT, CA, *DC

Estimated total Heat and Eat SNAP households (incl. 10% est. for CA, DC): 1.75 million

The Budget Reconciliation Bill that passed the House this week includes a section that restricts Heat and Eat Programs titled Section 1004: Availability of standard utility allowances based on receipt of energy assistance.

Section 10004 limits the availability of the SNAP standard heating and cooling allowance from anyone receiving more than $20 in LIHEAP payments to only households that include a senior (60+) or a person with a disability receiving more than $20 in LIHEAP payments.

Should the Budget Reconciliation Bill be enacted, non-senior/disabled households will no longer benefit from Heat and Eat programs, lowering hundreds of thousands of SNAP enrollees' monthly benefit amounts.

For example, a household containing a non-senior/disabled parent and a child in Pennsylvania with an income of $1800/month and rent expense of $800/month with utilities included would be likely eligible to receive $379/month in SNAP under the current Heat & Eat rules. If the changes in the Budget Reconciliation Bill went into effect, that household would likely see their benefits drop to $220/month.

Based on the number of households currently receiving a nominal LIHEAP payment, here are the estimated number of households that would no longer be able to use their LIHEAP payment to claim the standard heating and cooling allowance:

States with over 100,000 SNAP households losing Heat and Eat: NY, MD, WA, PA, *CA

States with 0–100,000 SNAP households losing Heat and Eat: MA, CT, MI, RI, OR, ME, MT, CA, *DC

Estimated SNAP households losing Heat and Eat (10% est. in CA, DC): 1.04 million

A report from the Congressional Budget Office provides the following analysis: "CBO expects that monthly benefits would decrease by roughly $100 for about 3 percent of households, on average, in each year over the 2026–2034 period. CBO estimates that enacting section 10004 would reduce direct spending by $6 billion over the same period."

| State | Heat and Eat Households (2022/2024) 2 | Total Participating SNAP Households (Jan 2024) 4 | Approx. Heat and Eat % | Percent SNAP Households Elderly/Disabled 1 | Est. Households Losing Heat and Eat |

|---|---|---|---|---|---|

| MD | 251,2383 | 378,251 | 66% | 32% | 170,842 |

| NY | 283,512 | 1,686,225 | 17% | 46% | 153,096 |

| WA | 212,600 | 508,087 | 42% | 38% | 131,812 |

| PA | 301,229 | 1,064,248 | 28% | 44% | 168,688 |

| MA | 142,630 | 673,591 | 21% | 48% | 74,168 |

| CT | 97,149 | 227,629 | 43% | 44% | 54,403 |

| MI | 83,181 | 801,111 | 10% | 39% | 50,740 |

| RI | 42,081 | 89,407 | 47% | 46% | 22,724 |

| OR | 10,803 | 428,111 | 3% | 37% | 6,806 |

| ME | 6,776 | 100,250 | 7% | 53% | 3,185 |

| MT | 1,047 | 41,363 | 3% | 38% | 649 |

| CA5 | — | 3,097,449 | — | 36% | — |

| DC6 | — | 82,550 | — | 34% | — |

Notes and Analysis Limitations:

(I) IN GENERAL.—Subject to subclause (II), if a State agency elects to use a standard utility allowance that reflects heating and cooling costs, the standard utility allowance shall be made available to households [with an elderly or disabled member] that received a payment, or on behalf of which a payment was made, under the Low-Income Home Energy Assistance Act of 1981 (42 U.S.C. 8621 et seq.) or other similar energy assistance program, if in the current month or in the immediately preceding 12 months, the household either received such a payment, or such a payment was made on behalf of the household, that was greater than $20 annually, as determined by the Secretary.

(f)(1) Notwithstanding any other provision of law unless enacted in express limitation of this paragraph, the amount of any home energy assistance payments or allowances provided directly to, or indirectly for the benefit of, an eligible house-hold under this title shall not be considered income or resources of such household (or any member thereof) for any purpose under any Federal or State law, including any law relating to taxation, food stamps, public assistance, or welfare programs.

(2) For purposes of paragraph (1) of this subsection and for purposes of determining any excess shelter expense deduction [received by a household with an elderly or disabled member] under section 5(e) of the Food Stamp Act of 1977 (7 U.S.C. 2014(e))--

(A) the full amount of such payments or allowances shall be deemed to be expended by such household for heating or cooling expenses, without regard to whether such payments or allowances are provided directly to, or indirectly for the benefit of, such household; and

THIRD PARTY ENERGY ASSISTANCE PAYMENTS.—

(A) ENERGY ASSISTANCE PAYMENTS.—For purposes of

subsection (d)(1), a payment made under a State law

(other than a law referred to in paragraph (2)(G)) to provide energy assistance to a household [without an elderly or disabled member] shall be considered

money payable directly to the household

(B) ENERGY ASSISTANCE EXPENSES.—For purposes of

subsection (e)(6), an expense paid on behalf of a household [with an elderly or disabled member]

under a State law to provide energy assistance shall be

considered an out-of-pocket expense incurred and paid by

the household.

Additional Sources: